Bitfinex banking continues to scare, Bitcoin Premium Skyrockets, Tether Dumps

Since the foundation of the first crypto-to-fiat platform, exchanges have been subjected to intensive research by banks, regulators and, above all, the consumers and investors themselves. Despite his veteran status in this burgeoning industry, Bitfinex is not exempt from this control, because a few too many controversies have caused the Hong Kong-based startup to shake during its nearly six-year history. Reports suggest that the next scandal is currently brewing, causing traders to wonder – what does the future offer for Bitfinex?

Bitfinex opens account Fiat payments are closed with HSBC

Per knowledge, as relayed by Bloomberg, Noble Bank, a financial services provider from Puerto Rica, dropped its customers in early October because of severe financial problems. Although this news slipped under the radar of legal market investors, many in the close-knit crypto community were shocked when sources revealed that Noble had lost the business of Bitfinex and Tether.

Although this news was perhaps quite common to any other established crypto platform, such as Coinbase or Gemini, the fact that Bitfinex lost its primary banking partner for the umpteenth time caused a lot of criticism. During the relatively short history of the platform, the finances of the company were thrown around like a hot potato, because the bank partners that the stock exchange searched for did not feel comfortable to associate with Bitfinex.

The tumultuous history of the exchange has not gone unnoticed, because many well-intentioned crypto traders have outlined their apparent hatred of Bitfinex in a few too many moments. The situation of Noble was of course no different, with many people who immediately went to Twitter to claim that Bitfinex was on the verge of falling into financial decline. As the deposits of the euro, the Japanese yen and the large pound sterling were eliminated after the news of Noble Bank broke, the appearance of a price premium began, with Bitcoin trading a higher amount on Bitfinex compared to the other main platforms.

In a clambering to secure a bank relationship, as spotted by Larry Cermak from The Block on Saturday, the startup secured a business account at HSBC, the world's seventh bank, under a shell account. As explained later by The Block, Bitfinex & # 39; as a customer of HSBC did not come out, because the exchange had to close 100% of the deposit deposits on Thursday.

This further fueled the rumors about the financial insolvency of Bitfinex, allowing thousands of users to liquidate their Bitfinex credit credit in exchange for crypto-assets. Moreover, the fact that Bitfinex's leadership is linked to that of Tether & # 39; s also did not help the situation, as many have "loosened" their USDT massively, leading to the reportedly USD-supported stablecoins that fell to less. than $ 0.98 each for some platforms.

Bitfinex & ed., A popular but controversial Twitter page that emphasizes "Bitfinex / Tether fraud", had a lot to say about the situation because he / she is not the biggest fan of the platform, to put it nicely.

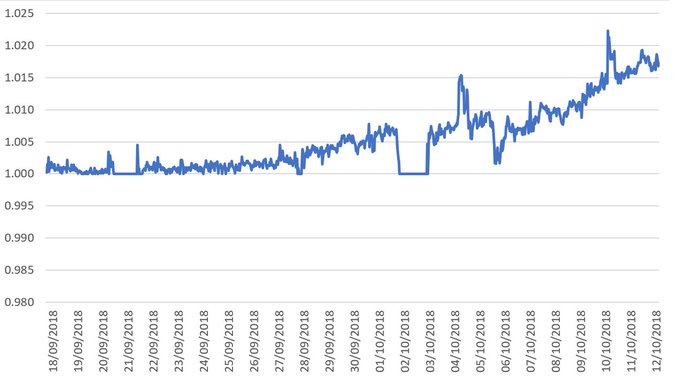

Thousands on Twitter and Reddit echoed Bitfinex & ed; s sentiment, resulting in a snowball effect that saw the premium on potentially double-paid exchange expansions to extremely high marks. According to data compiled by the BitMEX research team, the Bitcoin price premium on Bitfinex is close to 1.75% and is only planned to continue to grow.

The Block & # 39; s Cermak confirmed this report and revealed its own set of numbers indicating that Bitfinex not only sees a premium, but also all exchanges that support Tether. In fact, the two largest stock exchanges in the world, Binance and OKex, which coincidentally offer USDT trading pairs, have had more than 1% premiums due to the dump of USDT tokens on their platforms.

While Bitfinex & # 39; top copper & # 39; expect the situation to normalize within a week, if this normalization does not happen by chance, the concerns that Bitfinex is insolvent and Tether is not supported can spread like wildfire.

Hypothetically speaking, while the crypto industry could probably recover from the collapse of Bitfinex, if Tether would bite the dust, this burgeoning space can be anything but lost. More specifically, because USDT plays an integral role in the main exchanges of this market, some fear that the sudden dissolution of the stablecoin will damage the reputation and safety of this industry if it is not returned.

This, along with a multitude of other potential reasons, is why many have baptized Tether, the "biggest crypto scam". or a similar expression to that effect. In addition to cynicism, a message from the exchange indicates that the Bitfinex team is doing its utmost to solve the solution, so for now it is all about playing the waiting game.

Comments

Post a Comment